The commissioners on the Cook County Board of Review have a name for the tax attorneys who argue cases before them: campaign contributors.

An Illinois News Network analysis of donations made to the campaigns of the three sitting commissioners found the majority of contributions come from lawyers who argue before the board or real estate developers who make property tax appeals.

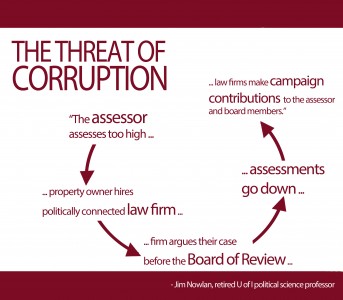

“This looks like a totally corrupt system. These people are not giving these people donations out of the goodness of their heart,” said Jim Nowlan, a retired political science professor at the University of Illinois. “There is a reason why Cook County is one of the only jurisdictions in the United States where commercial property owners feel like they have to hire an attorney to handle their property tax appeals.”

He added campaign contributions themselves are not the problem.

The problem is the law firms and politicians involved in the current system have little incentive to correct the situation.

Commissioner Dan Patlak said he has seen no evidence that any member of the Board of Review has in any way been influenced by political giving when deciding cases.

While for many voters the Board of Review is a relatively obscure panel, it has captured the attention of campaign contributors.

According to Illinois Reference, during the course of their careers the board’s current commissioners have raised:

Larry R. Rogers, Jr.: $2.3 million

Dan Patlak: $875,971

Michael Cabonargi: $671,625

Commissioners receive a salary of $100,000 per year.

Chicago lawyer John G. Locallo is a past president of the Illinois State Bar Association and a partner in the property tax appeal law firm, Amari & Locallo.

Chicago lawyer John G. Locallo is a past president of the Illinois State Bar Association and a partner in the property tax appeal law firm, Amari & Locallo.

“I give to both Republicans and Democrats. I don’t give to influence them, I give to help good people get elected to office,” he said.

Beyond the donations from attorneys and real estate developers, there are other interest groups who give to the candidates. For example, as Cook County’s remaining farms are encroached upon by municipalities, it is important that land continue to be assessed for agricultural purposes, Farm Bureau Manager Bob Rohrer said.

“We want to give to candidates who have an understanding of the needs of farmers,” he said. “Does it give us an advantage when cases come before the board? I really couldn’t tell you.”

But Dick Simpson, a political science professor at the University of Illinois at Chicago said commissioners can’t help but be influenced by donations.

“I don’t know if staff is told to give better deals to certain law firms,” he said. “But the commissioners certainly know who is giving to them.”

Nowlan added the current system works to the detriment of ordinary taxpayers and to the benefit of politically connected law firms and the elected commissioners.

“When these large commercial properties in the downtown pay less than they should on their taxes, then the difference gets made up by ordinary taxpayers and that’s not right,” he said. “In most jurisdictions commercial firms don’t feel the need to hire a lawyer to appeal their taxes. The only people who benefit in the Cook County system are the politically connected lawyers who are getting the business and elected officials who are getting the contributions. It doesn’t benefit anyone else.”

Be First to Comment