Jan. 26, 2009

Story by John McCarron of LISC/Chicago

Ordinarily, Michelle Winding tries to help renters facing eviction stay in their apartments until they can find another place to live. But Winding knows danger when she hears it, and the steady splat of water falling on the kitchen floor of a nearby vacant unit all but shouted “burst water pipe” – more evidence of another North Lawndale building in the death throes of foreclosure.

Winding is foreclosure advocate at Lawndale Christian Development Corp. (LCDC), a position funded through the NCP Foreclosure Response Fund. She’s also very busy, now that RealtyTrac, the online information service, lists nearly 11,000 properties within the Lawndale ZIP code either in loan default, foreclosure proceedings or already repossessed by lenders.

Tag along with her on a home visit, however, and it’s obvious Winding deals with a lot more than the dry legal mechanics of foreclosure and eviction.

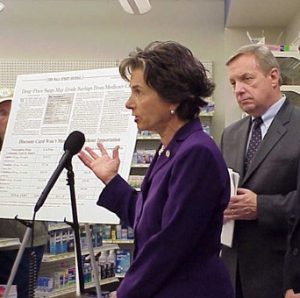

Michelle Winding of NCP lead agency Lawndale Christian Development Corp. (LCDC) counsels Erica Maxey, on the couch with daughter Ariel, 5, and son D’Angele, 3. PHOTO BY: JOHN MCCARRON

On a bitter cold Monday three days before Christmas the visit is also about client morale — witness a box of clean linens, winter clothes and used toys brought for the three children of Erica Maxey. And about finding a job, because you can’t rent a two- or three-bedroom apartment anywhere in Chicago, Winding reminds, if your only income is public assistance and Food Stamps.

“She’ll need at least one month’s rent and a security deposit,” said Winding, “so she needs to get a job… because without a job, even if she finds another place, she’d be back in the same situation in a few months.”

So Winding makes an appointment for Maxey, 23, to come to the computer lab at LCDC where she will be helped to write a resume. Next step: a placement interview at the North Lawndale Employment Network (NLEN), one of LISC/Chicago’s Centers for Working Families. Meantime she’ll try to find Maxey and her kids a safer place to live, even if that means a shelter.

“You don’t want to become a crutch,” Winding explained. “It’s better to empower people with the education, resources and information they need to make it on their own. But with all these foreclosures and evictions, well, it can be hard.”

* * *

Like most renters in foreclosed buildings, Erica Maxey was blindsided by her eviction notice. It was delivered by an agent hired by Deutsche Bank, which held the loan on her third-floor unit. According to Cook County Circuit Court records, the dowdy red-brick six-flat on the 1500-block of South Lawndale Avenue was purchased by an investor group back in 2005 and converted into six “condominiums” — each promptly re-sold to buyers for about $200,000 apiece.

Winding, pictured at her LCDC office, is tracking about 20 families evicted due to foreclosure proceedings. PHOTO BY: JOHN MCCARRON

Early last year the banks making those condo loans began foreclosing on the absentee buyers. Deutsche Bank was granted legal possession of Erica Maxey’s third-floor unit just before Thanksgiving, having prevailed over a delinquent borrower whose name Maxey never heard of until the eviction papers arrived.

“I just kept paying rent to the [building] manager all that time” she said. “We didn’t get any notice this was going on.”

* * *

Attorney Mark Swartz is assigned to the Tenant Foreclosure Intervention Project run by Lawyers’ Committee for Better Housing, another partner with NCP’s foreclosure response team. He helps foreclosure victims — mostly renters — referred by neighborhood outreach workers such as Lawndale’s Winding.

Swartz spends a lot of time in eviction court helping the evicted, or soon-to-be evicted, gain more time to find another place, and, if possible, some financial assistance from the foreclosing lender.

Rarely has he been able to help a renter stay indefinitely. The tsunami of foreclosures eventually may change this practice, but for now, virtually all foreclosing lenders seek to evict existing tenants as soon as they can.

“They just don’t want to be landlords… don’t want the liability,” Swartz said of the banks, many of which are headquartered in distant cities, yet ended up holding Chicago mortgages as part of bundled investment vehicles.

In their haste to re-market foreclosed buildings, lenders hire local agents whose tactics range from the scary, and often illegal, five-day eviction notices, to more benign-sounding “cash-for-keys” offers. Sometimes, when a building is unsafe, Swartz favors moving out ASAP, but generally he presses for more time and money. A little cash can be critical because many tenants, left in the dark about foreclosure proceedings, keep on paying rent long after their landlords stop making payments on their loan.

Many don’t find out their landlord has a problem until foreclosure is finalized and the sheriff’s deputy or lender’s agent knocks on the door.

“I’m working on a case now where the tenants paid their last month’s rent the same day the sheriff’s deputy showed up to evict them,” Swartz said.

Two recently enacted laws may help. Last year Chicago mended its Residential Landlord and Tenant Ordinance to require owners to notify tenants within seven days of receiving a notice of foreclosure. Amendments to the Illinois Mortgage Foreclosure Act, meanwhile, give rent-current tenants the right to an extra 120 days, or the duration of their lease, whichever is shorter.

But with so many buildings entering foreclosure, Swartz said, the legal fight for extra time and money, while important, is not a long-term strategy to help renters cope with the foreclosure crisis. “Our ultimate goal,” he said, “has to be preservation of affordable apartments. That’s the next step.”

* * *

Judge Sheldon C. Garber has never seen anything like it in 24 years on the bench.

“We’ve been so busy; I’ve just had another judge assigned to help with the [court] calls,” said Garber, who supervises the First Municipal District of the Circuit Court of Cook County.

Foreclosure cases were up by about 11,000 countywide to more than 42,000 in 2008. But those cases are heard in the court’s Chancery Division. Garber’s Municipal Division is where lenders go to seek evictions, more properly known as “Forcible Entry and Detainer Actions for Possession.”

Located on the 14th floor of the Daley Center, it’s not a very cheery place, though Garber exhibits a good deal of sympathy for responsible renters caught up in the foreclosure mess.

“The lenders want to clean the property out and make it more saleable. So they’ll offer maybe $500 in relocation expenses or whatever. But the tenants have their own issues. Maybe they didn’t know this was going on, or they’ve been paying rent to the wrong owner. It gets messy, but we try to be reasonable.”

Like attorney Swartz, the judge worries what the foreclosure epidemic will mean long-term for affordable housing in the city.

“We’re losing our supply, definitely,” he said. “We’ve already had so many [affordable] buildings rehabbed for condo conversion, so many CHA high-rises demolished. It’s not just foreclosures, but this makes it a lot worse.”

Categories:

Citywide Editor’s Choice Planning & Development Public Social Issues

Tags:

affordable housing chicago foreclosure housing lisc north lawndale

Be First to Comment