Ald. Deborah Graham (29th Ward) and Rep. Camille Lilly (D-Chicago) walked a block in Austin last week to get a first-hand look at the foreclosure crisis and how it’s affecting residents in the West Side neighborhood.

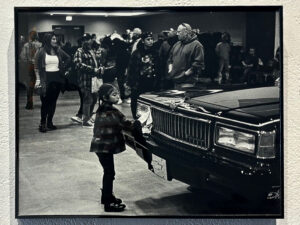

More than 30 people took part in the “tour” and heard Steven McCullough, chief executive officer and president of Bethel New Life present alarming statistics – facts like in the last 16 months, US Bank has been involved in 366 foreclosures on Chicago’s West Side and neighboring suburb of Oak Park.

McCullough also noted that in all of 2009, US Bank filed 1,927 foreclosures citywide, the third highest for any financial institution.

A representative from US Bank could not be reached for comment.

Elce Redmond of the South Austin Coalition, a grassroots community group that advocates for the area’s low-income residents, said no one seemed surprised by the numbers. That’s because when driving the streets of Austin, Redmond noted, there’s rarely a block that doesn’t have at least one boarded up or abandoned house – a tell-tale sign of foreclosure.

“’Do Not Enter’ signs and ‘Foreclosed’ signs are becoming a commonality in this community, and that is where the problem lies,” Redmond said. “This is what is happening in the community, and the elected officials, as much as the residents, want to put an end to foreclosures and start the next step, which is getting people back into their homes.”

McCullough said abandoned and boarded-up buildings are a dire problem on the West Side because vacant spaces get taken over by drug dealers and gangs.

“These vacant homes lead to increased gang activity and violence,” he said. “It is time for US Bank to be held accountable, and we want them to meet the same community standards and the same level of community involvement that we had with Park National Bank.

Park National Bank was seized by federal regulators in October, and its operations were turned over to US Bank. Park National was widely praised for its relationship with the community and its residents.

A study by the Chicago Rehab Network found that in March 2010 alone, there were 1,763 newly filed foreclosures and 1,896 completed foreclosures in Chicago. In Austin’s three wards – the 28th, 29th and 37th – there were 102 newly filed foreclosures and 128 completed foreclosures.

According to the same Chicago Rehab Network study, JP Morgan Chase Bank leads all banks in Chicago with 235 forecloses, followed by Deutsche Bank National Trust Co. with 171, US Bank with 167, Wells Fargo Bank with 110 and CitiMortgage Inc. with 109.

The Coalition to Save Community Banking and McCullough are asking US Bank to establish a $25 million foreclosure pool that would go directly to rehabbing foreclosed properties so families can live in them.

“Basically, we are asking them to create a community stabilization fund for families on the West Side,” he said. “In addition to rehabbing foreclosed properties, we are asking US Bank to provide more support for our residents in the form of counseling and also using loan modification to give families a chance to stay in their homes.”

Redmond said elected officials and everyday residents need to know what’s happening in their community.

“We live in this community, and we drive the streets of this community, but it is rare to stop and look around at what is happening in this community,” he said. “It was important for us to get out on the streets and take a walk and realize what is happening.”

McCullough said Austin residents must speak up and be heard. He said the livelihood of the West Side community is relying on a partnership with US Bank that doesn’t exist, and without it the foreclosure problem will only continue to get worse.

“They can do more,” he said. “The meeting is about putting a face on the problem and putting the pressure on the bank to step up and be accountable.”

US Bank and locally elected officials have been invited by the Coalition to Save Community Banking to a town hall tonight at 6:30 in Hope Community Church, 5900 W. Iowa.

The meeting is designed to put pressure on US Bank to work with the community and the residents of Austin on the foreclosure problem, Redmond said.

Be First to Comment