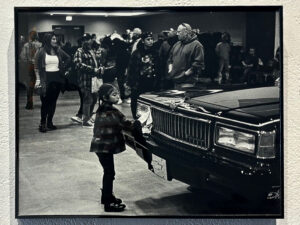

Shred your fears about identity theft with the Better Business Bureau and various government agencies, on June 25th. You are invited to protect their identities by shredding unwanted personal, financial or confidential documents for FREE. This is the annual “Shred It and Forget It” Shredder Day at the United Center Parking Lot E, in Chicago, from 9 a.m. to 2 p.m..

Electronics recycling also will be available. This year an electronics recycling service is provided by Vintage Tech Recyclers. TVs, monitors, laptops, PCs, servers, data storage devices, printers, fax/copy machines, cell phones, VCRs, DVD players, video cameras and game consoles are among the types of electronic equipment that will be collected for recycling at the event.

Crime statistics show that more than 8.1 million people became victims of identity theft in the past year making it the fastest growing crime in the U.S.

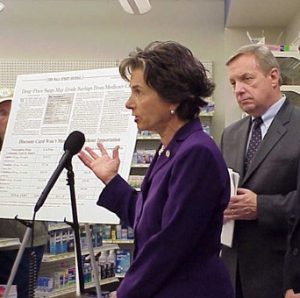

Hosts of the annual event include the Better Business Bureau along with the City of Chicago’s Department of Business Affairs & Consumer Protection, Cook County State’s Attorney’s Office, Federal Trade Commission, United States Postal Inspection Service, Chicago Police, Illinois Attorney General’s Office, and the Cook County Department of Environmental Control.

Participants are asked to limit the material they want shredded to 10 boxes of documents per person. There will also be a free home shredder given away every 15 minutes during the event. You may also visit www.chicagoshreds.com to sign up for a chance to win one of two home shredders that will be given away online.

Representatives from the participating organizations will be on hand at “Shred It and Forget It” to offer guidelines for shredding documents and to answer questions about how to keep your personal information safe.

- A good rule of thumb is to keep all tax returns and supporting documentation for seven years. The IRS has three years from your tax-filing date to audit, and has six years to challenge a claim.

- Keep credit card statements for seven years if tax related expenses are documented.

- Keep paycheck stubs for one year. Be sure to cross reference the paycheck stub to the W-2 form.

- Be sure to keep bank statements and cancelled checks for at least one year.

- Bills should be kept for one year or until the cancelled check has been returned. Receipts for large ticket items should be kept for insurance purposes.

- Home improvement receipts should be kept for six years or permanently.

- Items such as birth certificates, social security cards, insurance policies, titles or wills should be kept permanently in a safety deposit box.

- When you are going to dispose of documents with sensitive information, be sure to SHRED!

More information about “Shred It and Forget It” Shredder Day can be found at www.chicagoshreds.com once there, consumers may also sign up for notification on future Shred Day events.

For more information on how to protect your identity, visit www.bbb.org

Related articles

- Should I be shredding ALL my receipts? (ask.metafilter.com)

Be First to Comment