Advocates for a Chicago “Robin Hood Tax” marched through the LaSalle Street financial district on Monday chanting, “What is America going to be? Corporate greed or democracy?”

Advocates for a Chicago “Robin Hood Tax” marched through the LaSalle Street financial district on Monday chanting, “What is America going to be? Corporate greed or democracy?”

Forty-one people were subsequently arrested after they blocked the entrances to the Chicago Board of Trade building,

The protesters are demanding a financial transaction levy they say could generate an estimated $10 – $12 billion in annual revenue for Illinois, which faces a $5 billion dollar 2016 deficit and tens of billions more in long-term pension debt obligations.

Fair Economy Illinois, the group that organized Monday’s march, is demanding lawmakers explore progressive revenue options like the transaction tax before they slash the budgets for social services.

Illinois is entering it’s 5th month without an operating budget. Gov. Bruce Rauner is refusing to sign any budget passed by Democrats, until his pro-business, anti-union “structural reforms” are included. Democrats have called his reforms “non-budget items.”

The transaction tax, dubbed the “LaSalle Street tax,” would cover transactions made at the Chicago Board of Trade, Chicago Mercantile Exchange and Chicago Board Options Exchange.

CME Group spokesperson Michael Shore said via e-mail that such a tax would hurt more than help.

“Transaction taxes on futures and options would be bad for business, resulting in job losses here and declines in state and local tax revenues,” Shore said.

This is by no means the first time CME has threatened to leave Illinois over tax squabbles.

Meanwhile, Kristi Sanfo rd, communications director for IIRON, said the state and the city are “taxing working people to death” and maintained revenue must come from “those who can pay.”

rd, communications director for IIRON, said the state and the city are “taxing working people to death” and maintained revenue must come from “those who can pay.”

Sanford is willing to call CME’s bluff on leaving the state.

“After getting their $77 million annual tax break from Springfield, CME has no incentive to leave,” Sanford said.

Mayor Rahm Emanuel, a former CME board member, has rejected the idea, but ultimately the decision lies with Springfield, not Chicago.

Illinois House and Senate bills to establish a financial transaction tax were introduced earlier this year, but neither has yet made it out of committee.

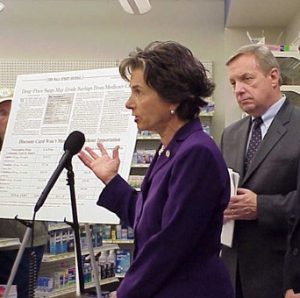

State Rep. Barbara Flynn Currie (D-Chicago), who chairs the House Rules Committee, said she is in support of the house bill, but getting it to pass is up to her colleagues.

“I think it makes financial sense,” Currie said. “There’s no reason why we shouldn’t follow cities that have imposed a similar tax, like London.”

A transaction tax in London, a global financial hub, generated over $30 billion in 2014.

Currie also said there’s been no effort from Illinois Speaker of the House Michael Madigan (D-22nd District) or Rauner to garner support for the bill.

Steve Brown, Madigan’s spokesperson, said the Speaker has not taken a position on the bill and had no comment on CME’s threat to leave Illinois if a financial transaction tax is imposed. Similarly Rauner has not made any comment.

Any comment from Rauner could be construed as a conflict of interest, as the wealthy businessman owns an equity stake in the Chicago Board Options Exchange, according to his financial disclosures.

Sanford, noting Rauner’s threats to cut social services in the next budget if his anti-union conditions are not met along with Madigan’s blocking of any budget from being passed, blames both parties for letting the rich off the hook at the expense of the poor.

“Who needs Rauner’s cuts when you have Madigan and Democrats who do nothing for poor working people?” Sanford asked rhetorically.

Mehrdad Azemun, campaign director for National People’s Action, a group whose mission is to “work to advance a national economic and racial justice agenda,” marched with the demonstrators.

He said along the way he noticed a lot of support from onlookers.

“We are the 99%. It resonates for a reason,” he said.

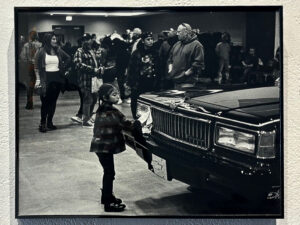

Linda Thomas, a professor at the Lutheran School of Theology, attended with her daughter Dora, a high school freshman in a show of solidarity with those in the state who are struggling.

“I’m impacted when another mother can’t get childcare for her children,” Thomas said, referring to cuts to the state-subsidized Child Care Assistance Program.

“My conscience cannot be at rest.”

Be First to Comment