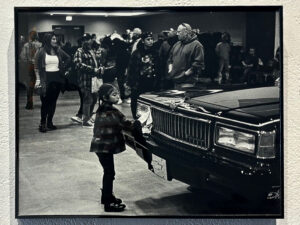

As police pushed back a group protesting in the Fannie Mae mortgaging company lobby, confusion hung in the air. Not only were employees and security perplexed that they didn’t catch wind of the approaching protestor group, but protestors themselves were equally shocked.

Stricken by the unexpectedly successful entry into one of the United State’s major federally funded mortgaging company buildings, confounded protestors were pushed back out toward the streets by police while office workers watched in wonder.

Beginning outside of the Daley Center, on September 11th, angry demonstrators stormed Fannie Mae mortgaging company’s Chicago building, located at 1 S. Whacker Dr., chanting “Hey Fannie Mae! Whaddaya say? How many homes did you steal today?”

The protest was the first part of a nationally coordinated effort called National Action Day, a national protest series that culminated in a march in Washington, D.C., on Sept. 27. Protestors from around the country gathered in Chicago and Atlanta on Monday and Los Angeles and New York on Wednesday to protest policies of Fannie Mae and Freddie Mac mortgaging companies, particularly Edward DeMarco, Director of the Federal Housing Finance Agency (FHFA.)

Protestors are angry that DeMarco won’t implement policies like principal reduction, which makes mortgage costs commensurate with mortgager income.

The FHFA was commissioned in 2008 and oversees the efficacy of the taxpayer-funded mortgaging giants for the federal government as a part of the Housing and Economic Recovery Act. The FHFA manages 14 housing-related government sponsored enterprises that were bailed out five years ago, including Fannie Mae and Freddie Mac.

Both companies purchase mortgages from the bank lenders that originate them, and since 2008 have been allocated $187 billion in taxpayer money, according to the FHFA’s website.

Protestors said DeMarco, a federal employee enlisted by the Bush administration five and half years ago, rejects policies like principal reduction, which refinances mortgages according to mortgager income. According to protestors, DeMarco’s approach is contrary to the vision of President Obama and Treasury Secretary Timothy Geithner.

DeMarco issued a statement on July 31 saying: “…FHFA has concluded that the anticipated benefits [of principal reduction] do not outweigh the costs and risks… FHFA concluded that Home Affordable Modification Program Principal Reduction Alternative did not clearly improve foreclosure avoidance while reducing costs to taxpayers relative to the approaches in place today.”

Protestors want President Obama to fire DeMarco and hire somebody who is “going to implement real solutions.”

“[Fannie Mae and Freddie Mac are] not working to keep people in their homes at all,” said Stewart Schussler, an organizer with the Albany Park Autonomo Center. “They’re just processing home foreclosures as quickly as they can and evicting people and making the housing crisis worse instead of doing something to alleviate it.

According to a self-survey by the FHFA, 519,339 loans were refinanced through Fannie Mae and Freddie Mac under the Home Affordable Refinance Program since the beginning of 2012. Since the program’s inception in 2009, Fannie Mae and Freddie Mac have financed more than 1.5 million loans through Harp.

“We want to prevent foreclosure whenever we can,” said Andrew Wilson, director of external and media relations at Fannie Mae. “We think it’s best for the borrower and for the community to avoid foreclosure, but it’s also better for Fannie Mae, better for the taxpayers and it’s better for the mortgage servicers.”

The FHFA survey also indicates that from April 2009 through May 2012, 977,833 trial modifications have been started. Of those, 99,054 have been disqualified, 322,488 have been cancelled, 523,757 have become permanent and 32,534 remain active.

Since FHFA’s inauguration in 2008, 1,981,855 homeowners have kept their property from going into foreclosure due to retention actions enacted by Fannie Mae and Freddie Mac.

Yet, people are still galvanized by perceived ineptitude on DeMarco’s part.

According to Toussaint Losier, an organizer with Chicago Anti-Eviction Campaign, Fannie Mae and Freddie Mac are cherry picking financially stable homeowners to augment retention numbers. Toussaint said even banks are responsive to mortgagor efforts, but Fannie Mae and Freddie Mac are resistant to keep low-income borrowers in their homes.

“There is a sort of back and forth in terms of whose responsibility it is to work out a home retention option [between Fannie Mae, Freddie Mac and the banks],” said Toussaint. “Whereas banks might be willing to work something out with families, Fannie and Freddie have been resistant to working out possibilities to keep families in their homes.”

Protestors said both companies create roadblocks that prevent some families from keeping their home, regardless of circumstances.

“Freddie Mac is preventing my family from getting back in our house,” said Alejandra Cruz, a member of the Cruz Family Nationwide Anti-Home Foreclosure Campaign. “They’re telling the banks that they will not sell the house back to [us] even if a third party buys it and is willing to sell the house to us.”

Mike Shane, a resident of Detroit who lives on a block with as many as 19 empty houses, said that Fannie Mae and Freddie Mac need to put more focus on the people because the peoples’ money is funding them.

“Fannie Mae is owned by the taxpayers and we’re faced with the ironic tragedy of evicting our neighbors and ourselves with our own money,” said Shane, an organizer with Moratorium NOW! Coalition to Stop Foreclosures, Evictions and Utility Shutoffs. “We want the destruction of our communities to stop, especially destruction initiated by taxpayer money.”

Be First to Comment