By Dimitrios Kalantzis, Contributing Editor, Lake Effect News

Last month the Institute for Housing Studies at DePaul University released a study, which found a significant increase in Chicago rental vacancies, from 5 to 5.7 percent in the last year.

Such findings seem intuitive.

As the Chicago region’s unemployment rate rose to double digits throughout the recession, most recently nearing 10.6 percent, many renters were forced to leave their apartments, either doubling up with friends or moving back home.

But perhaps less intuitive is that the internal deficiencies within the pre-recession rental market may have directly caused our economic meltdown.

“The genesis of the subprime mortgage crisis is the lack of affordable housing,” says James Shilling, professor of finance at DePaul University and director of the Institute of Housing Studies.

While discussing his department’s recent study last month with Lake Effect News, Shilling dropped a policy bombshell, one that may change the way cities like Chicago approach the problem of affordable housing.

To comfortably afford the median rent of a two-bedroom apartment, $1,004 according to 2009 HUD guidelines, a family must earn more than $39,000 annually.

Currently, an estimated 550,000 Chicagoans demand affordable housing, according to Shilling, while the market bears but 350,000 such units, leaving at least 200,000 residents without a viable renting option.

The picture grows bleaker.

“Not only is it a big gap,” Shilling said, “but the gap is increasing over time.” In the next 15 years, Shilling estimates that 75,000 more residents will be in need of affordable housing, housing that costs 30 percent or less of a tenant’s income. And in that time the existing stock of affordable housing will continue to drop, Shilling said.

This stock has already been deeply compromised by the economic boom of the last decade.

“Because credit was flowing, people were buying and converting,” said Shilling, of affordable rental apartments. In an unfortunately ironic twist, this created a housing economy that allowed the seedlings of the subprime mortgage crisis to fester.

“People were finding that their monthly mortgage payment was at the same level of their rents, or maybe lower,” Shilling said.

And the ethically-questionable banks seized the day.

“The financial institutions responded by offering subprime mortgages,” added Shilling.

What ensued is old news. From 2007 to 2008, the United States lost an estimated $10 trillion in household wealth.

But the crisis is not over. A second wave of foreclosures is upon us.

In the next two years, “there is $1.3 trillion worth of commercial mortgages are that are coming due, a large part of which are multifamily loans,” Shilling said.

And as rental vacancies rise, Shilling contends, “we’re likely to have another round of defaults.” Building owners won’t have the necessary rents to pay their mortgages.

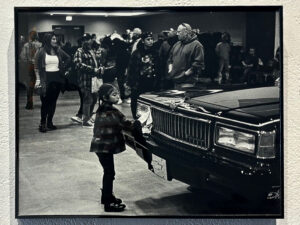

For a neighborhood like Uptown, in which an estimated 25 to 50 percent of residents are not finding affordable housing, the country’s response to the economic sequel of 2008 is critical.

“In Uptown and other places the consequences are huge,” Shilling said. “We really need a stabilizing force.”

But contrary to the aldermanic wisdom, which has invested more than $100 million to create 178 new affordable housing units, Shilling hopes both the state and federal governments step in to preserve existing buildings for affordable housing, not finance new ones.

“There are various government programs that encourage the construction of multifamily affordable housing,” said Shilling.

“In this current [economic] environment, that’s not what you want.”

Be First to Comment